Democrats Are Proposing Realistic Solutions, but Terry McAuliffe Isn't Listening

By Colin McAuliffe (@ColinJMcAuliffe)

Terry McAuliffe, the former Democratic Governor of Virginia, recently penned an op ed where he called for “realistic” solutions to the country’s problems while leaving open the possibility of a presidential run. McAuliffe argued against tuition free college, saying that it would be inappropriate to use taxpayer money for tuition for children of well to do families. For what it’s worth, the public doesn’t seem to buy into this argument. Civis Analytics polled tuition free college for Data for Progress, and included an explicit tax increase as well as McAuliffe’s argument that the program would benefit wealthy families (as a counterargument from a Republican), but the policy had net support anyway.

What’s troubling about this argument is that it can be used against any universal program such as K-12 education, Social Security, or Medicare. There are important debates to be had about education policy, especially on how to create pathways to the middle class that do not require college at all. However, simply noting that the wealthy would benefit is not a compelling reason for why means testing might be appropriate for a particular program, and potentially undermines political support for benefits that many rely upon.

Appealing to the notion of the rich getting a free ride from tuition free college is particularly cynical, since McAuliffe and other centrist Democrats rarely (if ever) acknowledge that the economic system is itself a free ride to the wealthy. For decades, the wealthy in the US have enjoyed enormous gains in income and wealth simply by the virtue of the fact that they were wealthy in the first place.

Economists have noted that the labor share of national income, or the portion of the gross domestic product that is paid as compensation to workers, has been in decline. The remaining portion goes to several other places, including a significant part to the capital share, or the share of national income that is paid to owners of capital.

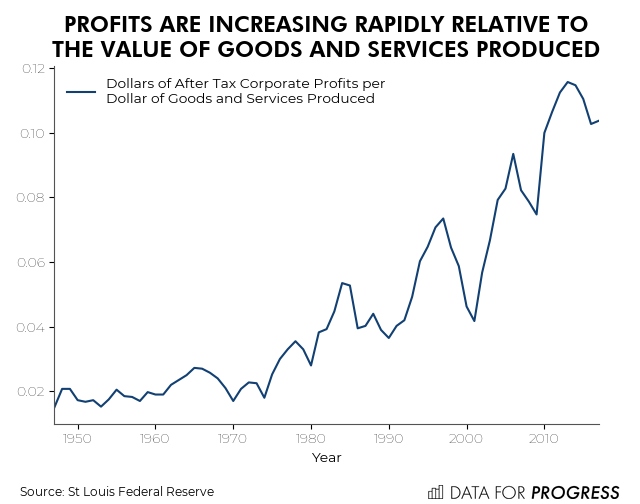

Declining labor share combined with declining effective corporate tax rates has lead to huge increases in after tax corporate profits. Unit profits are after tax corporate profits as a fraction of the national gross value added, which is the value of all goods and services produced in the country. From the 50’s through the mid 70’s, about 2 cents of after tax profits were generated from one dollar of goods and services produced. By 2017, this figure exploded to 10 cents on the dollar.

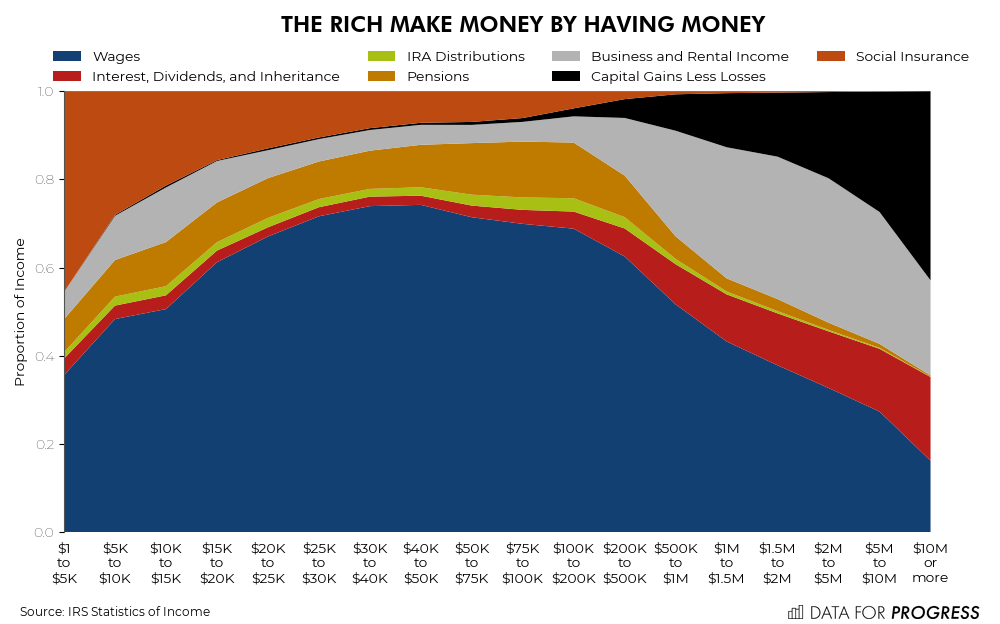

Ultimately, the overwhelming majority of these gains in income are not paid to those who work producing goods and services, nor are they used to provide for people in need. Instead, they are paid to people who own things, which is to say the wealthy. The IRS reports income source by size of adjusted gross income. In 2016, the overwhelming majority of people earn money from wages earned by working, in addition to work-derived benefits like pensions and earned benefits like Social Security and Unemployment Insurance (some miscellaneous income sources like gambling winnings are excluded).

This is in sharp contrast to those with incomes of over 10 million per year, who receive income primarily from asset ownership. Capital gains, interest, dividends, and inheritance account for the majority of this group’s income, while wages and salaries account for less than 20%. Business and rental income is also a significant category for upper income households (a portion of this counts as labor income while another portion is capital income, but it’s not possible to separate these two components with this particular dataset). Data from past years show that this distribution of income is not a new phenomenon. Note also, these calculations do not account for the wealthy’s various tax avoidance strategies.

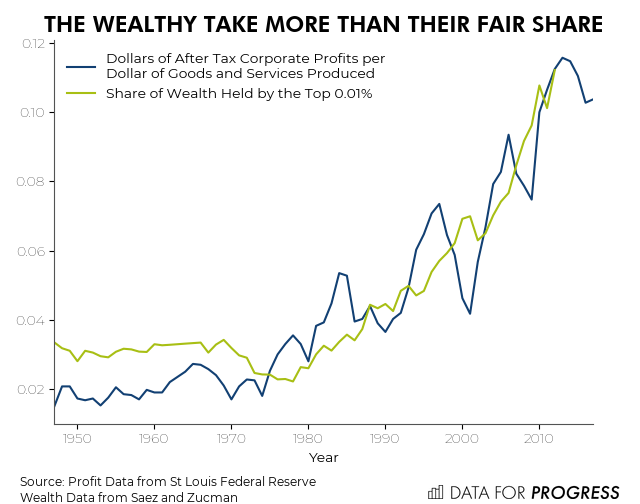

The fact that the wealthy own most assets not only means that they take large incomes from those assets, but their wealth grows as the value of the assets they own increases. Data on historical wealth shares shows that the increased rate of profits has coincided with an increased share of wealth help by the top 0.01% of households. As economist Stephanie Kelton says, the wealthy take more than their fair share.

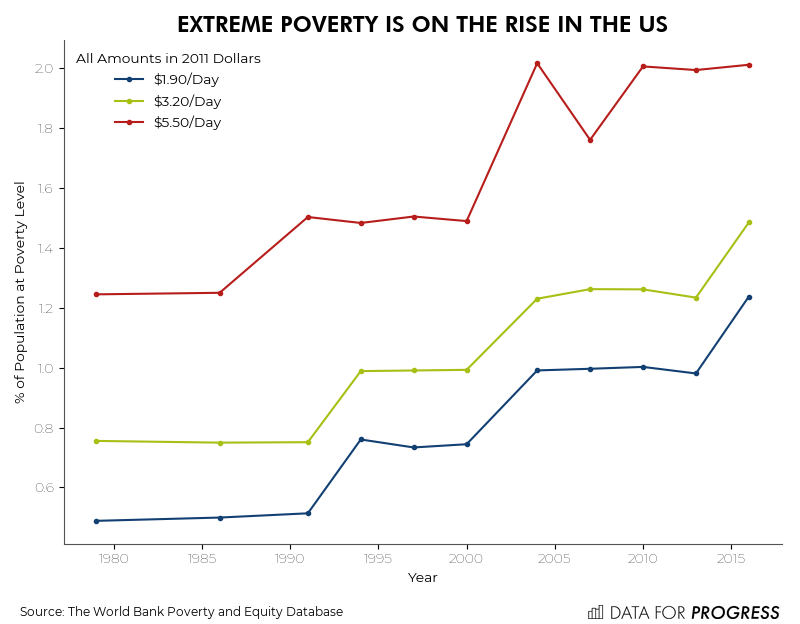

While the wealthy take vast sums of money from owning assets, real wage growth has been stagnant for most income levels. The number and rate of Americans living in extreme poverty has also been rapidly rising according to metrics used by the World Bank (the official US poverty line is about $21.70 a day in 2011 dollars, but the World Bank uses additional levels).

These are not ‘natural’ outcomes, but instead are the result of specific policy choices. Many Democrats are saying so (perhaps this is what McAuliffe means by “dishonest populism”), and are proposing real, practical solutions.

Stagnant wages in times of record profits are largely the result of weak bargaining power for labor, and several Democrats have proposed legislation meant to rectify this. Senators Warren (D-MA), Wyden (D-OR) and Murphy (D-CT) have proposed the Workforce Mobility Act, which would ban non-compete agreements that employers use to deter workers from finding a job elsewhere. One of the contributing factors to the decline in labor power has been the decline in the unionization rate. Senator Sanders (D-VT) and Representative Pocan (D-WI 2nd District) have introduced the Workplace Democracy Act, which makes it easier for workers to form unions and bars various tactics employers use to prevent their workers from unionizing.

Senators Warren and Baldwin (D-WI), have introduced two pieces of legislation for codermination, which requires corporate boards to reserve a portion of their seats for representatives elected by the firm’s workers. This is a policy which has very robust public support, and is associated with reduced income inequality since it helps limit the extent that shareholders are able to take more than their fair share of what a firm produces.

Senator Warren also introduced a sweeping set of anti corruption reforms which would establish new disclosure laws for financial conflicts of interest and would put a lifetime ban on members of congress and agency heads from becoming lobbyists once they leave office. These reforms would cut back on the undue influence that the corporate sector has over Washington, and could help restore public confidence in our institutions by eliminating the actual and apparent conflicts of interest. McAuliffe himself was the founder and co owner of a law and lobbying firm called McAuliffe, Kelly & Raffaelli from 1985-1994, though his role at the company did not involve lobbying himself.

Civil rights activist Coretta Scott King argued that unemployment and poverty were forms of violence, and that the economic precarity they produced were central to enforcing racial hierarchies. She fought for guaranteed employment and income as a right. FDR’s second bill of rights included “The right to a useful and remunerative job in the industries or shops or farms or mines of the Nation.” The ambition and vision of these leaders stands in sharp contrast to McAuliffe’s casual dismissal of a job guarantee as unrealistic. To be clear, there are significant administrative challenges to delivering a right to a job, just like there are administrative challenges in delivering K-12 education. Democrats have started the process of addressing those challenges; Senator Booker (D-NJ) has introduced legislation for an experimental pilot job guarantee program.

Representative Alexandria Ocasio Cortez (D-NY 14th District) has floated the idea of a 70% marginal tax rate on income over 10 million. This rate is in line with historical rates in the US, and discourages the wealthy from rent seeking (capturing income without creating value).

The list could go on, but the point should be clear: some Democrats want to change the rules of the game and create a system that works for everyone, and their policy solutions are popular and empirically sound. McAuliffe and other centrists should join their colleagues who are tackling the root causes of dysfunction and inequity in the economy, and should stop attacking universal programs while they protect a system that is designed to allow the wealthy to extract enormous amounts of money from the workers who create real value in the economy.

Colin McAuliffe (@ColinJMcAuliffe) is a co-founder of Data for Progress.