The Biden Administration’s Student Debt Relief Plan Is Popular and Will Benefit the Economy

By Anika Dandekar, Matt Mazewski, and Adewale Maye

Last week, President Biden and the Department of Education unveiled a three-part plan to address the growing burden that the student loan debt crisis has placed on American families. Prior to the plan’s announcement, Data for Progress polling had demonstrated strong support for various student loan forgiveness proposals.

New Data for Progress polling conducted from August 26-28, after details of Biden’s plan were released, shows that a majority of voters support all of its major provisions. Moreover, our findings provide further evidence that this policy could have long-lasting economic benefits and that claims it will substantially worsen inflation are likely overstated.

Biden Administration’s Student Debt Relief Plan and All Its Provisions Are Popular

When given a detailed description of what the plan would accomplish, likely voters support it by a +13-point margin. Democrats support the plan by a +77-point margin and Independents support it by a +5-point margin. Twenty-eight percent of Republicans support the plan, while 69 percent oppose it. Although voters who are current student loan borrowers are the most favorably disposed (supporting the plan by a +56-point margin), a majority of past student borrowers support the plan by a +6-point margin. Voters who were never borrowers back the plan by a +1-point margin.

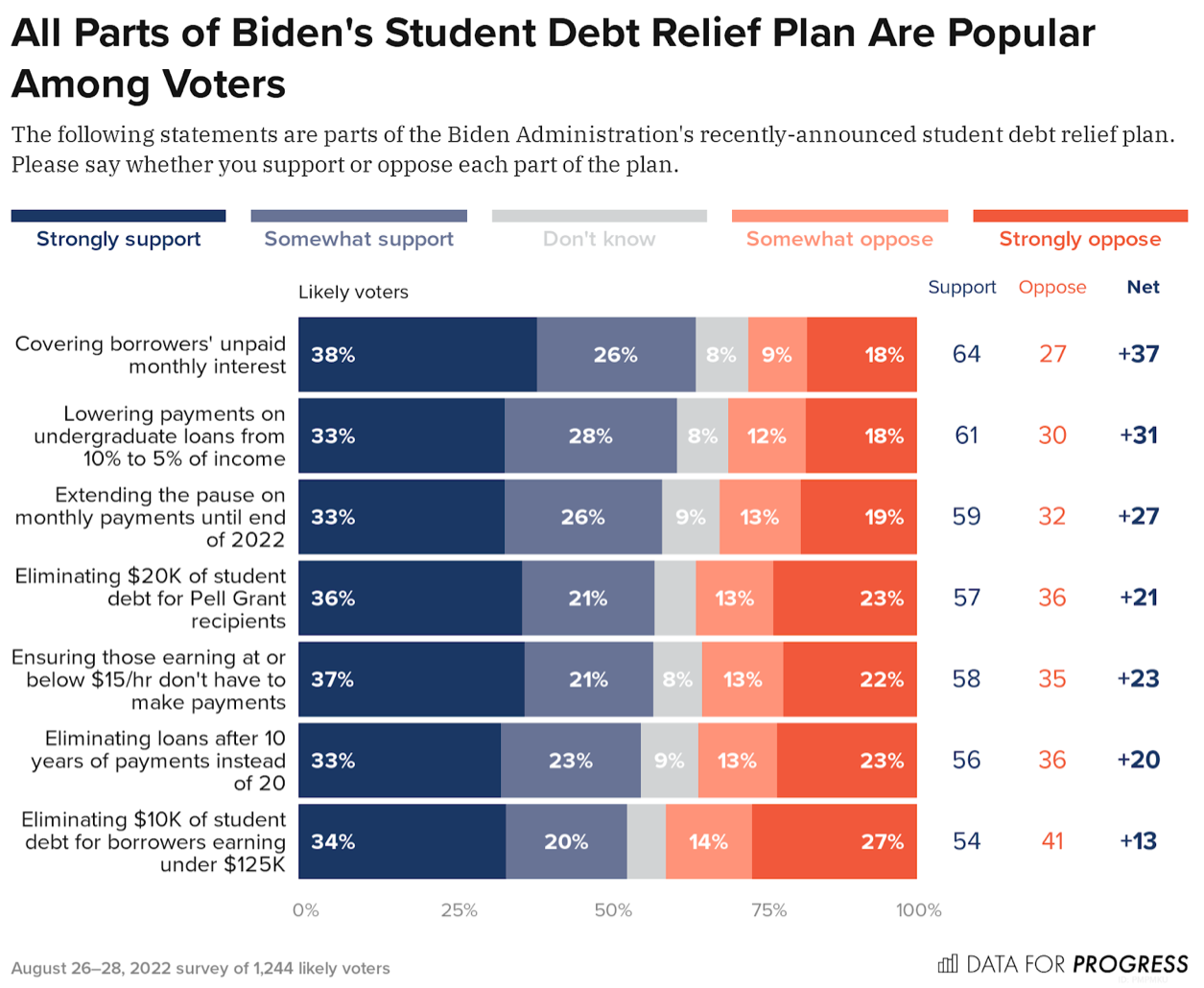

In order to gauge support for each element of the plan, we also asked voters whether they support or oppose each major provision individually. On net, voters support:

Covering unpaid monthly interest by a +37-point margin;

Capping monthly payments at 5 percent of income by a +31-point margin;

Extending the current pause on payments through December 31 of this year by a +27-point margin;

Forgiving $20,000 for those who were Pell Grant recipients by a +21-point margin;

Ensuring that no one earning less than $15 has to make monthly payments by a +23-point margin;

Forgiving loan balances after 10 years of payment instead of 20 years if the balance is lower than $12,000 by a +20-point margin; and

Forgiving $10,000 of debt for borrowers earning no more than $125,000 by a +13-point margin.

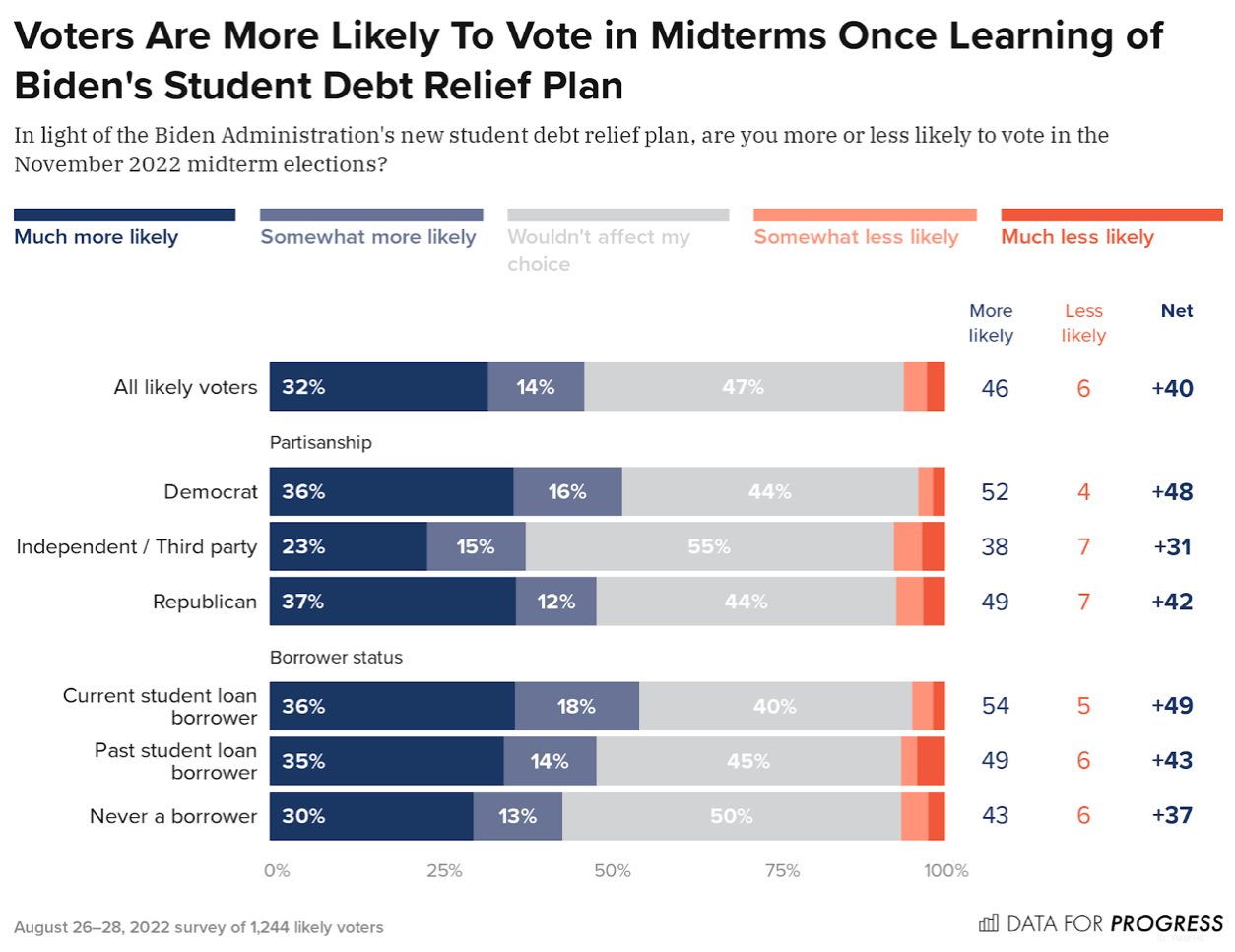

Voters Are Motivated to Vote in Midterms in Light of Student Debt Relief

We find that 46 percent of voters say they are more likely to vote in the November elections in light of the new student debt relief plan. Fifty-two percent of Democrats, 38 percent of Independents, and 49 percent of Republicans say they are more likely to vote in the midterms in light of Biden’s student debt relief plan.

Borrowers’ Savings and Spending Predictions Foretell Positive Economic Impacts

Critics have argued that student debt forgiveness will lead to worsened inflation at a time when prices are already rising at a historically rapid pace. To get a better sense of how the recent debt cancellation plan might affect the financial decision-making of current student borrowers, we asked the subset of voters who reported that they currently have student loan debt a series of questions about what changes to their savings or spending they expect in light of the plan’s enactment.

Around 1-in-3 voters who are student borrowers indicate that they expect to save more as a result of the student debt relief plan, with 32 percent saying they would do more to prepare for short-term emergencies and 35 percent saying that they would save more for long-term goals like a wedding, retirement, or a child’s own college tuition. A slightly greater share of voters — 38 percent — express an intent to reduce other debt balances like credit card debt or pay off bills.

We find that while 41 percent of voters who are student borrowers respond that they would increase their spending on basic necessities, such as food, housing, and healthcare, a mere 5 percent say they would make more discretionary purchases of luxury goods or donations. This suggests that any increases in consumption are unlikely to strain durable goods supply chains. That increased spending on basic necessities is expected to represent the largest change to consumer expenditures indicates that many student borrowers have previously been making tough sacrifices in order to get by.

Notably, 17 percent of borrowers indicate that the new plan would not have much effect at all on either their saving or spending. This could be due in part to our poll capturing student borrowers who are not eligible for any of its provisions. It might also suggest that for at least some of those who are eligible, the various provisions will have offsetting effects. For instance, borrowers may respond to the resumption in monthly payments several months from now by drawing down existing savings and otherwise leaving their spending patterns unchanged, despite a reduction in the total balance that they owe.

Indeed, the Committee for a Responsible Federal Budget (CRFB), which has recently claimed that student loan forgiveness “would likely boost the inflation rate by … between a sixth and a quarter point increase,” just last year maintained that “partial student debt cancellation is poor economic stimulus” precisely because “the majority of canceled debt would result in no improvement in cash flow [for borrowers] this year,” and because they are “unlikely to spend a large share of that cash-flow improvement” in any event.

In this earlier modeling, CRFB projected the share that would be spent for different groups by drawing on existing estimates from the economics literature of this so-called “marginal propensity to consume.” However, our poll findings suggest that these estimates may even be too high when it comes to the policy at hand: For a majority of borrowers, the share spent may be effectively zero. Future research based on a retrospective analysis of borrowers’ spending decisions following implementation could help to shed more light on this issue, but our results provide another theoretical reason to suspect that existing forecasts of an inflationary impact have been overstated.

While saving for things like a wedding could imply greater spending at some point in the future, the fact that these expenditures will only take place years from now means that their contribution to inflation in the immediate term will be nil. If the administration’s plan helps to build personal wealth and strengthen household balance sheets, it could actually have important longer-run benefits for the economy. These include making individuals and families less financially vulnerable to fluctuations in interest rates or promoting intergenerational income mobility.

Conclusion

This study shows that the Biden Administration’s student debt relief plan and all its provisions are supported by voters, and may be a motivating factor for voters in the upcoming midterm elections. The research also suggests that claims about inflationary impacts of student debt cancellation are overstated, with many borrowers opting to save more or spend only on basic necessities.

Individual policies that are designed to improve the lives of working Americans should not all be expected to bear the burden of addressing our inflation problem on their own. As the Roosevelt Institute’s Mike Konczal and Ali Bustamante have pointed out, reducing inflation requires a “whole-of-government approach” and “should not preclude the Biden Administration from addressing the other economic pressures and inequities Americans are facing.” Measures designed to, for instance, improve supply-chain resilience and mitigate pandemic-related disruptions to economic activity should be the focus of such an approach.

Most importantly, the student debt relief plan will be a first step in addressing systemic inequities, helping average Americans cope with rising costs and build wealth for generations to come.

Anika Dandekar (@AnikaDandekar) is a polling analyst and Data for Progress.

Matt Mazewski (@mattmazewski) is a fellow at Data for Progress.

Adewale Maye (@AdewaleMaye) is a fellow at Data For Progress.