Voters Support Postal Banking

By Senator Kirsten Gillibrand

One in four people in America is unbanked or underbanked. That means they don’t have access to financial services most Americans take for granted, like checking and savings accounts, low-cost loans, and ATMs. And the financial services underbanked Americans can access, like predatory payday loans and check cashing, come at an extremely high price.

The Biden-Sanders Unity Task Force recently endorsed striking at the heart of this problem by ensuring access to basic financial services through the Federal Reserve and the Post Office.

I have a proposal, the Postal Banking Act, which would create a non-profit bank that could be accessed at every post office in every neighborhood in this country. It would make low-cost checking and savings accounts, low-interest loans, ATMs, and mobile banking available in every community at little to no cost, reducing geographic and financial barriers to banking. That would change millions of families’ lives while shoring up the Postal Service, a critical institution in critical condition.

This proposal has taken on a greater urgency in light of the ongoing economic and health crises facing our country. Even before the coronavirus pandemic put our economy in crisis, families without adequate banking were spending $100 billion a year cashing checks, sending money to relatives, and taking out payday loans. It’s expensive to be poor in America.

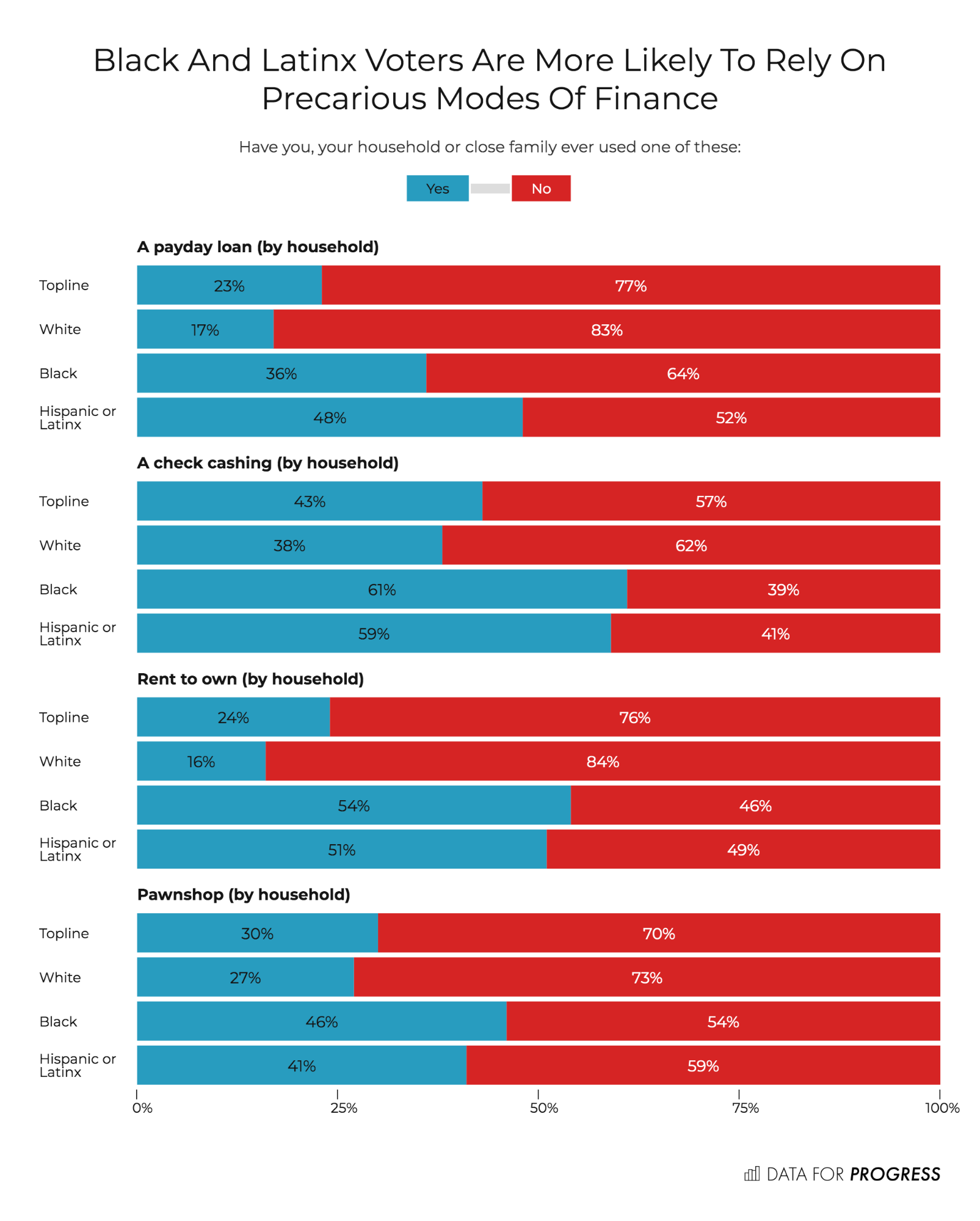

As Vice President Biden notes, addressing systemic racism and creating economic and social justice means addressing the role predatory financial services play in widening the racial wealth gap. FDIC data shows that Black and Hispanic families are five times more likely than white families to be unbanked, leaving them to pay exorbitant fees just to spend their own money. Data for Progress’s recent polling found that 36 percent of Black households and 48 percent of Hispanic households have sought a payday loan, compared to just 17 percent of white households. The same demographic split appears in the use of check cashing services, rent-to-own programs, and pawn shops.

Unbanked and underbanked families also tend to have lower incomes. They can least afford to lose a percentage of their paycheck or take out a high-interest loan when the car breaks down or there’s a medical emergency. These families need access to basic financial services that don’t constantly put them on the back foot.

Low-income families should not have to turn to a predatory service when they could turn to a trusted institution like the Postal Service. That’s why it is so important that the Biden-Sanders Unity Task force is not only focusing on this problem, but backing “efforts to guarantee affordable, transparent, trustworthy banking services for low- and middle-income families … including postal banking.”

In the wake of the Great Recession, banks began closing branches – most often in rural and under-resourced urban areas – leaving countless communities with no real options but predatory ones.

While those communities may not have banks, they do have post offices. There are more than 30,000 post office locations across the country, and almost 60 percent of them are in ZIP codes that are banking deserts, where there is no bank, or only one.

The post office is the perfect place to provide banking services. The USPS not only has the infrastructure and the staff necessary to offer local, low-cost banking, but they have the institutional experience. Postal banking was offered in this country from 1911 to 1967 and helped low-income families weather the Great Depression and two World Wars. After those accounts closed, the post office continued to handle Americans’ financial needs including their tax returns, Social Security checks, and billions of dollars of money orders.

Postal banking not only saves families money, it saves the Postal Service. Thanks to its unique requirement to prefund its pension and health care obligations 75 years in advance, the Postal Service’s finances are in dire straits.

Let’s eliminate that misguided policy, and create a new revenue stream for the post office in postal banking, strengthening its finances for years to come. A 2015 report from the Postal Service Inspector General found that, if USPS received just 10 percent of the alternative financial market, a similar version of postal banking to the one I’m proposing would create nearly $10 billion of revenue every year.

The Postal Service needs that revenue to survive. And the American people need the Postal Service to survive. Every day the post office delivers the paychecks and prescription medications that millions of lives depend on. And this fall, as the pandemic increases our reliance on voting by mail, the USPS will also deliver ballots our democracy depends on.

Postal banking is a win-win proposal that deserves its place in the Democratic Party’s vision for the future. As the Biden-Sanders Unity Task Force notes, “the extreme gap in household wealth and income between people of color, especially Black Americans, and white families is hurting our working class and holding our country back.” Postal banking is one way we can improve economic opportunity for people of color, help us close the racial wealth gap and create a more level financial playing field.

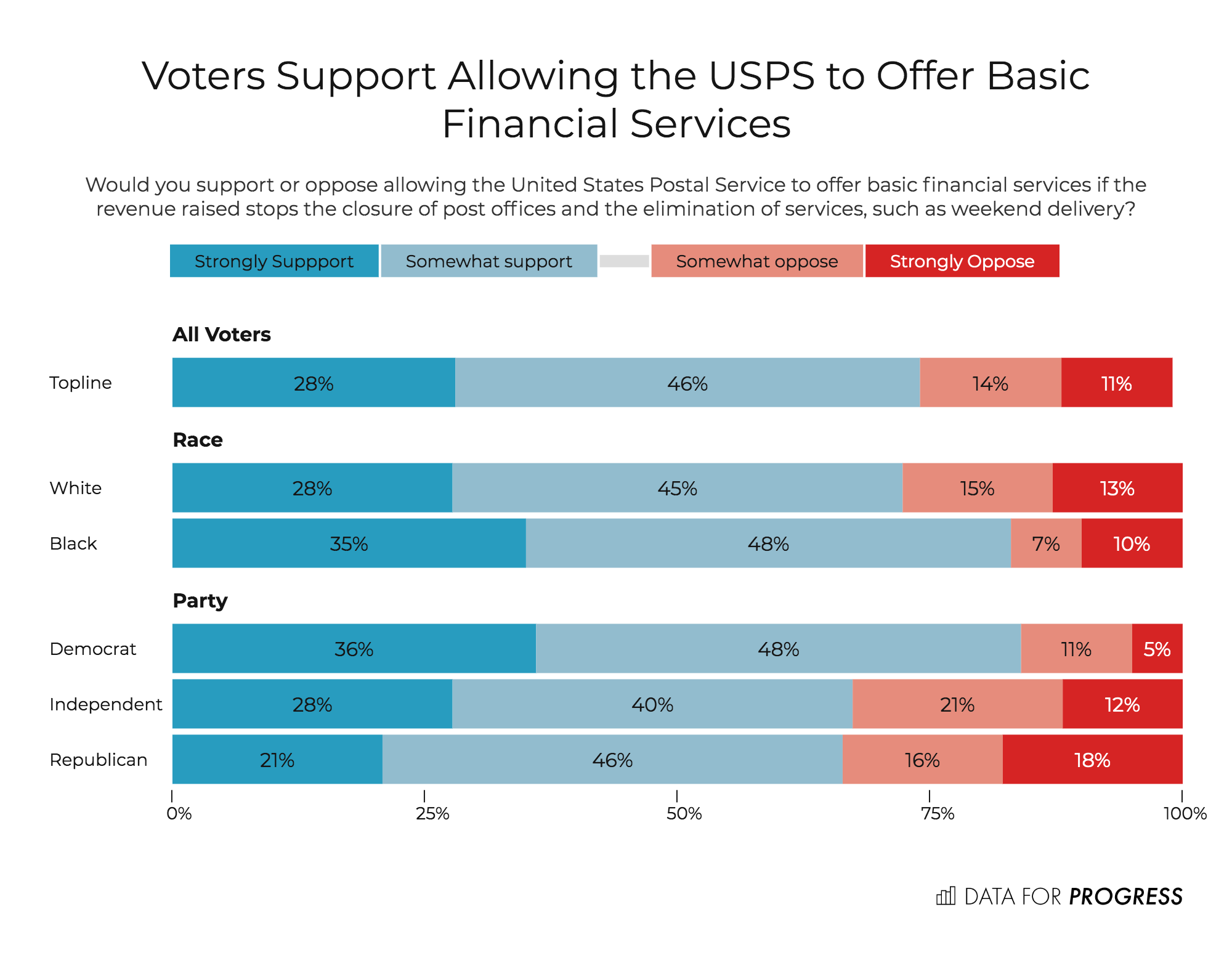

Even in this time of highly polarized politics, this is a proposal that has overwhelming support from Americans of all political leanings. Data for Progress found that 84 percent of Democrats and 67 percent of Republicans support postal banking.

I look forward to working with the Vice President on highlighting this proposal and ensuring that the American people gain access to what many of us take for granted.

The American people and Vice President Biden’s campaign recognize that postal banking does what the Postal Service does best: it delivers.

Kirsten Gillibrand (@SenGillibrand) is a Senator from New York.

On May 4, 2020, Data for Progress conducted a survey of 1,143 likely voters nationally using web-panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is ± 2.9 percentage points.