Out-Of-Work Americans Worry About Their Health and Finances as Expanded Unemployment Insurance Benefits Are Set to Expire

By Bennett Fleming-Wood and Brian Schaffner, Tufts University

The coronavirus has had an undeniably massive toll on the United States’s economy during the first half of 2020. The national unemployment rate for June was 11.1 percent, a sharp increase from the low 4 percent rate the Trump Administration touted pre-coronavirus. While Congress passed the bipartisan CARES Act on March 25th, which included stimulus checks and expanded unemployment benefits for many Americans, experts agree this is far from the last action the federal government will need to take to ease the economic impact of the coronavirus.

Economic Experts also agree that targeted interventions, such as stimulus checks, have the potential to leave certain groups behind. Furthermore, our current unemployment insurance system is designed to incentivize job-seeking by replacing only part of an individual’s lost income. Making matters worse, the temporary expanded unemployment insurance program is set to expire at the end of July.

Since mid-April, we have been tracking the impact that coronavirus has had on the U.S. workforce. Our research shows that people who lost their jobs during the pandemic are rightly worried about their financial situations and that they want even more aid from the government than the CARES Act provides. Indeed, Americans – especially those who are out-of-work – overwhelmingly support expanding and extending unemployment insurance.

Since mid-April, we have been asking respondents if they are more concerned about the impact of coronavirus on their financial situation or their health and well-being. The following figure shows that those who lost their jobs are generally less worried about their health than those whose work situations have been less impacted. In April, people who had lost their jobs were 25 points less concerned about their health than people working from home. This gap has narrowed slightly as the pandemic has recently worsened – in early July, 53 percent of people who had lost their jobs were more concerned about their health than their economic situation, while almost 70 percent of people working with reduced hours or working as normal were more concerned about their health.

What this first chart makes clear is that people who have lost their jobs during the pandemic are put in the difficult position of having to balance threats to both their health and their financial situations. The CARES Act was designed to relieve the economic insecurity generated by the pandemic, but while it has been a step in the right direction, it failed to fully address the economic concerns of out-of-work Americans.

Emergency economic interventions risk leaving certain groups out and can often be inefficiently distributed. Indeed, our data shows that the people who likely needed stimulus checks the most were actually slower to receive the aid. For example, in April, only 21 percent of out-of-work Americans had received stimulus checks, while over 35 percent of Americans working as normal had received their benefits. By May, this discrepancy had disappeared, but the data show that at least one-in-four unemployed Americans never received stimulus funds.

The fact that out-of-work respondents were slower to receive their funds (and that many did not receive stimulus checks at all) is especially troubling when we consider how important the money has been for the recipients. Indeed, the next graph shows that Americans said they spent their stimulus checks mostly on essential expenditures like housing and food, but this is especially true of those who lost their jobs. People who were out-of-work were 10 points more likely to spend their stimulus money on food or supplies, while those who lost their jobs and those with reduced hours were almost equally likely to spend on rent or their mortgage. Less than 10 percent of either group said that they spent their money on non-essential items.

In April, polling from Pew found that 53 percent of low income and 25 percent of middle income adults were expecting to struggle to pay their bills. Thus, it makes sense that stimulus checks were overwhelmingly used for essential expenses. Most Americans, regardless of their unemployment status, appeared to need their stimulus funds and likely could use even more support now.

The CARES Act stimulus checks and expanded uninsurance benefits provided much needed financial support to many Americans. But, it was not enough and many Americans do not have the savings to make it through the pandemic without long-term support. Yet, the extended unemployment benefits created by the CARES Act are set to expire at the end of this month, putting many Americans in danger.

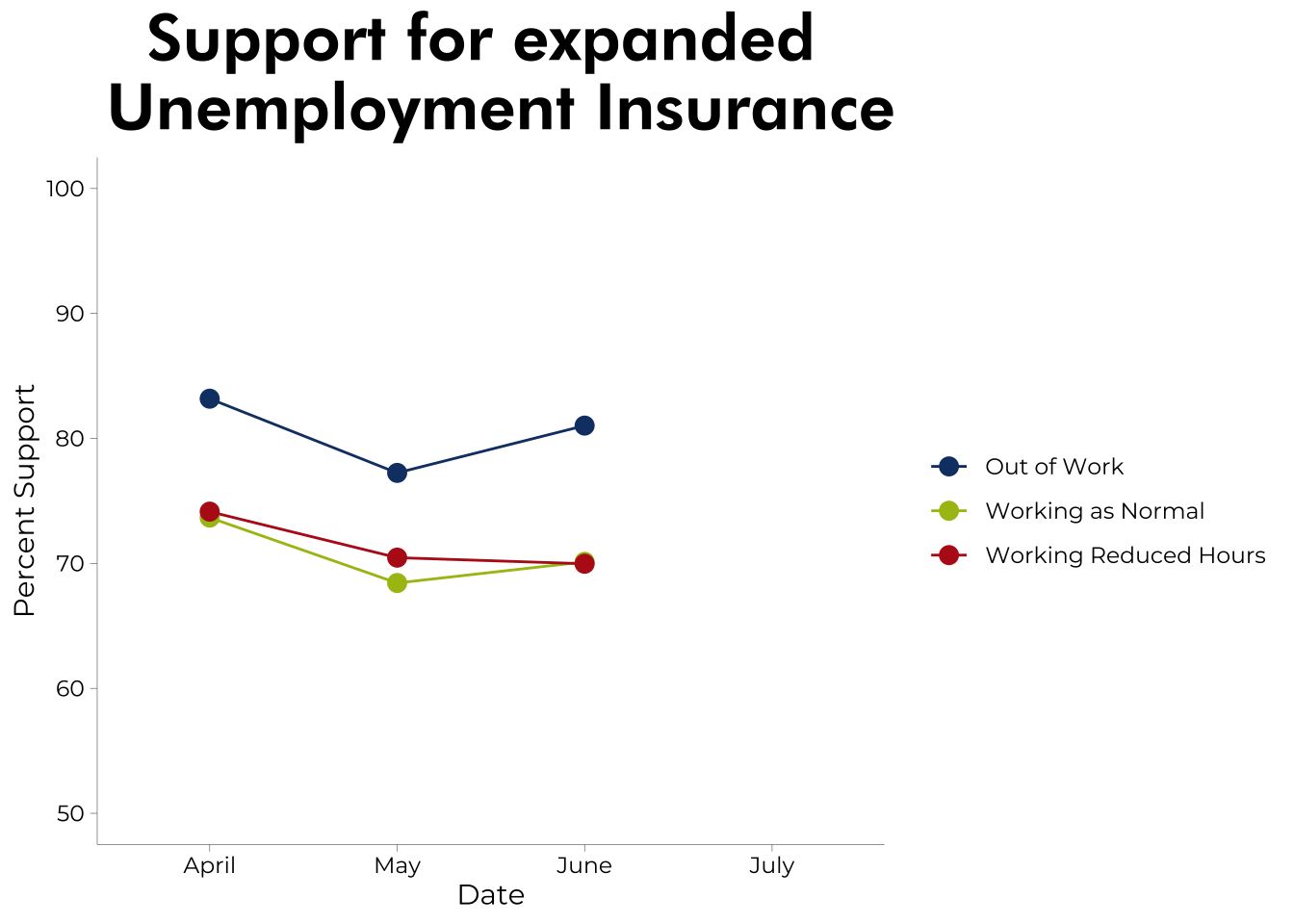

Our polling shows broad support for expanding unemployment insurance, especially among those without jobs. About four-in-five Americans who are out-of-work support a “long-term expansion of unemployment insurance to ensure American workers have income when they lose their jobs.” Even among those who are still employed, support for this policy reaches 70 percent.

We have also recently asked respondents about their support for extending the expanded unemployment benefits that were part of the CARES Act. Specifically, our question asks “would you support or oppose extending this unemployment insurance expansion until the unemployment rate falls to where it was before the coronavirus pandemic?” Once again, the vast majority of the American workforce supports this legislation regardless of their current work status. About three-fourths of those who are still employed support extending the unemployment insurance benefits while 86 percent of those who are currently out-of-work want the extension. Extending the expanded unemployment insurance program is not only overwhelmingly popular, but also quite crucial for the economic security of out-of-work Americans.

Given the precarious economic situation of so many Americans during the pandemic and the insufficient government response, it is not surprising that there is significant disapproval with how President Trump is handling the crisis. While Trump is under water among each of these groups, he receives especially low marks from those who have lost their jobs as a result of the pandemic. Out-of-work Americans are twice as likely to disapprove of how Trump has handled the coronavirus as they are to approve of his response to the crisis.

As the July 31st deadline for the expanded unemployment insurance benefits draws closer, the imperative for an extension to the program as well as additional stimulus payments is clear. Out-of-work Americans continue to struggle and they already rate Trump as performing quite poorly in his response to the crisis. Failure to agree on additional support for struggling Americans will not only further increase the economic insecurity of millions of Americans, but it is also likely to further damage Trump’s standing, particularly among the millions of jobless Americans who are currently worrying not only about their health, but also about how to make ends meet during an unprecedented crisis with no end in sight.

Bennett Fleming-Wood (@bennettfw36) is a rising senior majoring in political science at Tufts University.

Brian F. Schaffner (@b_schaffner) is the Newhouse Professor of Civic Studies at Tisch College and the Department of Political Science at Tufts University.