Voters Overwhelmingly Oppose Trump’s Plan to Defund Social Security

By Nancy Altman

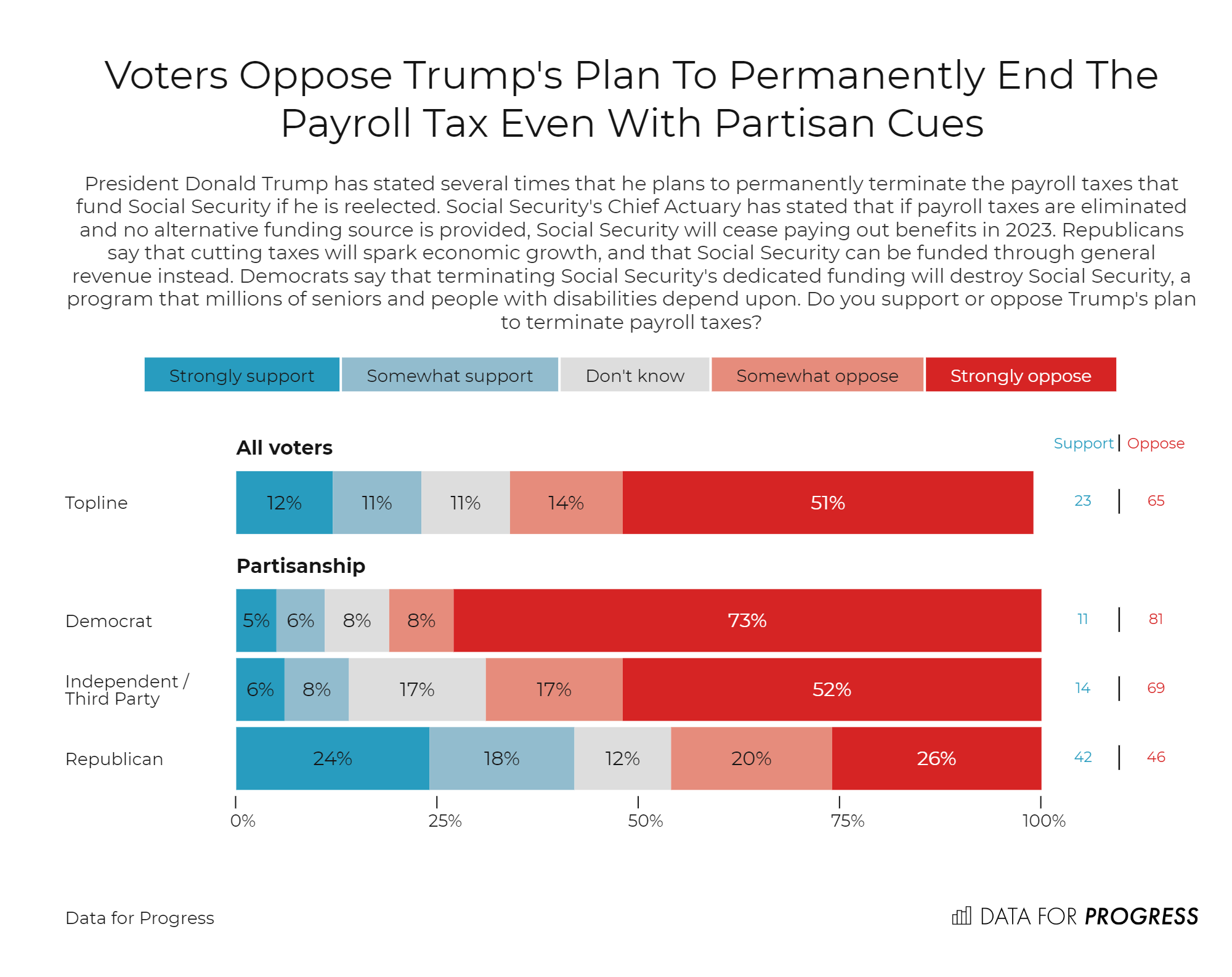

Donald Trump has promised that, if reelected, he will “terminate” payroll contributions, Social Security’s dedicated revenue. New, powerful polling by Data for Progress reveals that this promise is incredibly unpopular – even among Republicans.

To be clear, Trump says he will end “payroll taxes.” Though commonly used, the phrase “payroll taxes” is misleading. The monies, withheld from employees’ wages and matched dollar for dollar by employers, are more appropriately called insurance contributions or premiums. Authorized by the Federal Insurance Contributions Act, they are the monies withheld from workers’ pay in exchange for Social Security’s retirement annuities, life insurance, and disability insurance. As President Roosevelt explained, “We put those payroll contributions there so as to give the contributors a legal, moral, and political right to collect their [Social Security] pensions.”

Social Security does not add a penny to the deficit, because it can only pay benefits if it has the dedicated revenue to cover the cost. At a moment when the government is running unprecedented deficits, keeping Social Security self-financing is more important than ever.

The polling suggests that Americans understand all of this. We are divided on many issues, but Social Security isn’t one of them. Regardless of political affiliation, people understand the importance of Social Security’s modest benefits and don’t want to see the program’s funding jeopardized.

When people are asked about deferring or eliminating “the payroll tax,” told it funds Social Security, and given straightforward arguments for and against the proposal but given no partisan cues about who supports or opposes this plan, 71 percent oppose and only 17 percent support. The opposition consists of 74 percent of Democrats, 67 percent of Independents, and 70 percent of Republicans.

When people are asked essentially the same question but given several partisan cues — that it is a Trump plan, and the arguments for and against are characterized as, “Republicans say” and “Democrats say,” the percentages change somewhat but still show opposition, even by Republicans. With the partisan cues, the number of Democrats and Independents in opposition increases. While the number of Republicans in opposition drops substantially, more still express opposition than support.

This is a striking result. Republicans overwhelmingly support Trump. It’s extremely unusual for a policy supported by Trump not to get enthusiastic support from Republican voters. This shows that Social Security is one of the few issues that can break through even to hardened partisans.

Even when the question does not explain that “payroll taxes” fund Social Security, people still oppose the plan, but by a much smaller margin. Presumably, this is because many people do not realize, without being reminded, that “payroll taxes” are linked to Social Security

Nevertheless, even when Americans are not reminded of the special link between “payroll taxes” and Social Security, enough understand that important fact that they still don’t support the Trump plan. When given no cues, but simply asked, “Would you support or oppose a proposal to permanently eliminate the payroll taxes,” only 36 percent respond with support. Almost one out of two (47 percent) still oppose the idea. Nearly one out of five (19 percent) say that they don’t know.

There are at least two big takeaways from this groundbreaking polling. Enough people understand the link between Social Security and “payroll taxes,” that even when given no cues, two out of three (66 percent) respond that they don’t want that particular tax they pay to be cut or that they are unsure. That is astounding. What other tax do people want to keep, even without being directly told of the link to Social Security?

When everyone is clear that “payroll taxes” are the premiums that they are charged for their Social Security retirement annuities, life insurance and disability insurance, and they are given the arguments for and against in a neutral manner without partisan cues, almost everyone opposes even the deferral of those payments.

Those results are consistent with numerous polls revealing how unified Americans are in support of our Social Security system. Across the ideological spectrum, across all races, genders, religions, country of origin, and virtually every other demographic divide, Americans overwhelmingly believe Social Security is more important than ever. They agree that Social Security should be expanded, not cut. They want the wealthiest to pay more, and are even willing to pay more themselves if necessary to preserve the program.

The other important takeaway is the essential role the media has to play in discussions of Social Security, an issue that other Data for Progress polling shows off top importance to voters. The fact that the numbers are significantly different when the Social Security link isn’t specified shows that the many people aren’t aware of it.

The media has a responsibility to tell people that payroll contributions fund Social Security. A lot of the reporting has not done so. Explaining this connection is not just responsible journalism but an important public service, educating the electorate. By the same token, failing to make clear the implications of the Trump proposal to eliminate Social Security’s dedicated funding, is an extreme disservice.

Nancy J. Altman (@SSWorks) has a 40-year background in the areas of Social Security and private pensions. She is president of Social Security Works and chair of the Strengthen Social Security coalition. She is the author of The Truth About Social Security and The Battle for Social Security and co-author of Social Security Works! and the forthcoming Social Security Works for Everyone!

Methodology

From 9/4/2020 to 9/5/2020 Data for Progress conducted a survey of 1,231 likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, and voting history. The survey was conducted in English. The margin of error is +/- 2.6 percentage points.