Voters Across Party Lines Support a Global Minimum Tax

By Prerna Jagadeesh and Lew Blank

Every year, the U.S. loses more than $100 billion in tax revenue to overseas tax havens. That’s nearly 3 percent of America’s total federal revenue lost each year to boost the profits of giant multinational corporations like Apple, Microsoft, and Google. Corporate behemoths know that if they set up their headquarters in other nations with much lower tax rates — even if their business is predicated on selling to American markets — they can clean up without having to pay up, making profits off of American consumers while weaseling out of paying their fair share in taxes. This plays a significant role in contributing to global wealth inequality, by transferring wealth away from government services for people in need and enriching giant corporate behemoths.

How do we solve this problem? One of the most impactful proposed solutions is a global minimum tax, which would set a standard corporate tax rate across the nations of the world — and happens to be very popular with voters. After decades of inaction, governments are finally unifying around this idea: in early July, the U.S. and 129 other nations agreed to set a global minimum tax on corporations. While the exact rate of this global minimum tax hasn’t been finalized, the U.S. and dozens of other nations are pushing for a rate of 15 percent, meaning that every corporation would pay a minimum tax rate of 15 percent regardless of which country they report profits in. Even if some countries don’t sign on, the proposal would allow other nations to establish a “top-up levy” to bring the company’s total tax up to 15 percent.

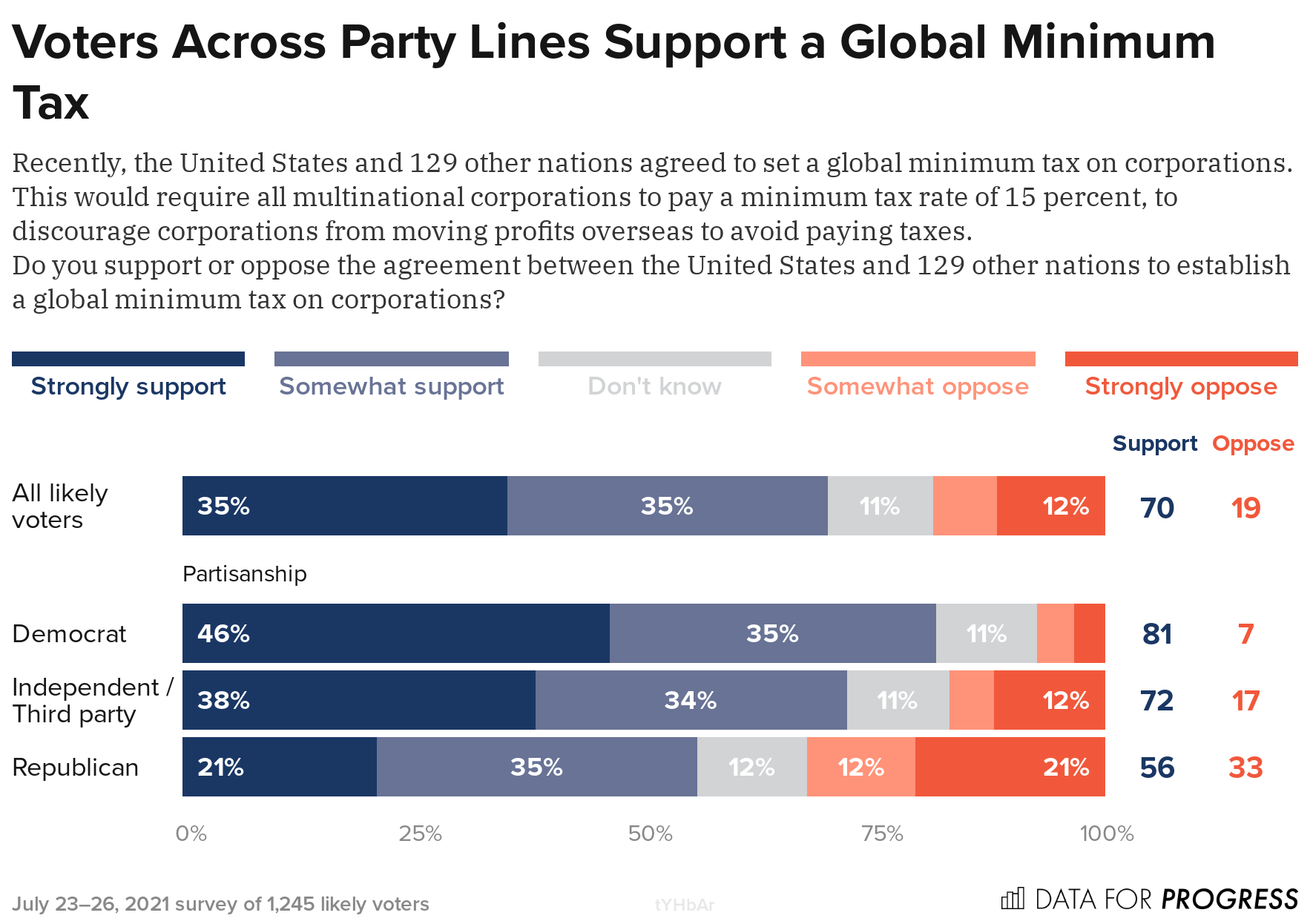

In a new national poll from Data for Progress, we find that voters agree it’s time for the United States to stop letting corporations off the hook when it comes to paying taxes. An overwhelming 70 percent of voters support the agreement between the U.S. and 129 other nations to establish a global minimum tax on corporations. This strong majority support for a global minimum tax extends across party lines: 81 percent of Democrats support it, along with 72 percent of Independents and 56 percent of Republicans.

For too long, the threat of corporations moving overseas to dodge taxes has impeded progressive Democrats’ efforts to set appropriate tax rates for corporations and enforce them. Instituting a global minimum tax will recapture crucial revenue for the U.S. government and de-incentivize corporations from moving jobs overseas, boosting the American economy. Democrats, Independents, and Republicans concur: it’s time to stop letting corporations run to the ends of the earth in order to avoid paying their fair share.

Prerna Jagadeesh (@PrernaJagadeesh) is a writer at Data for Progress.

Lew Blank (@LewBlank) is a senior writer at Data for Progress.