The Billionaire Minimum Income Tax Is Popular

By Jason Katz-Brown

Key Findings

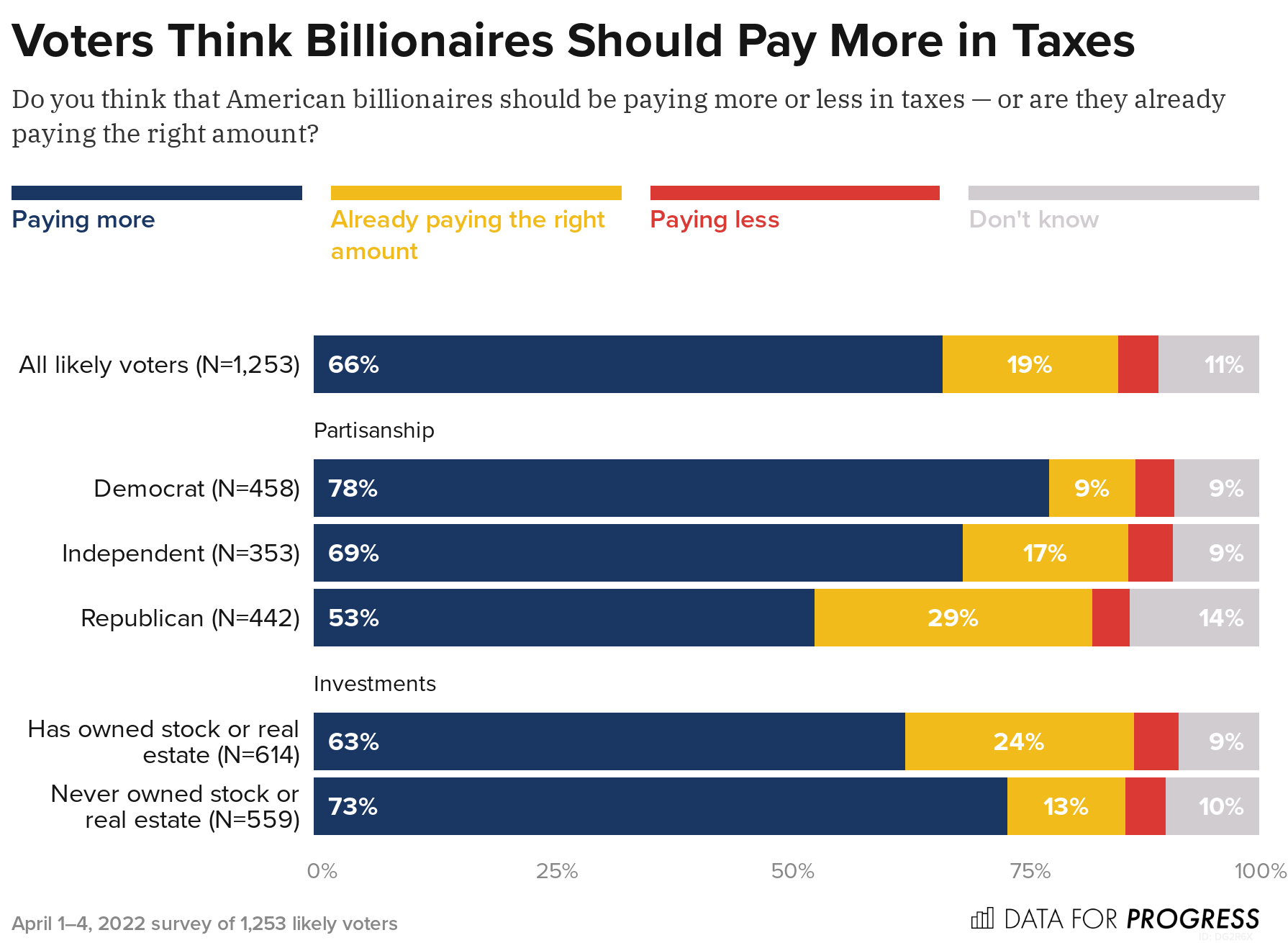

Two-thirds of likely voters, including 53 percent of Republicans, think billionaires should be paying more in taxes.

Less than half of voters understand that no tax is owed on investment gains if the investment is not sold.

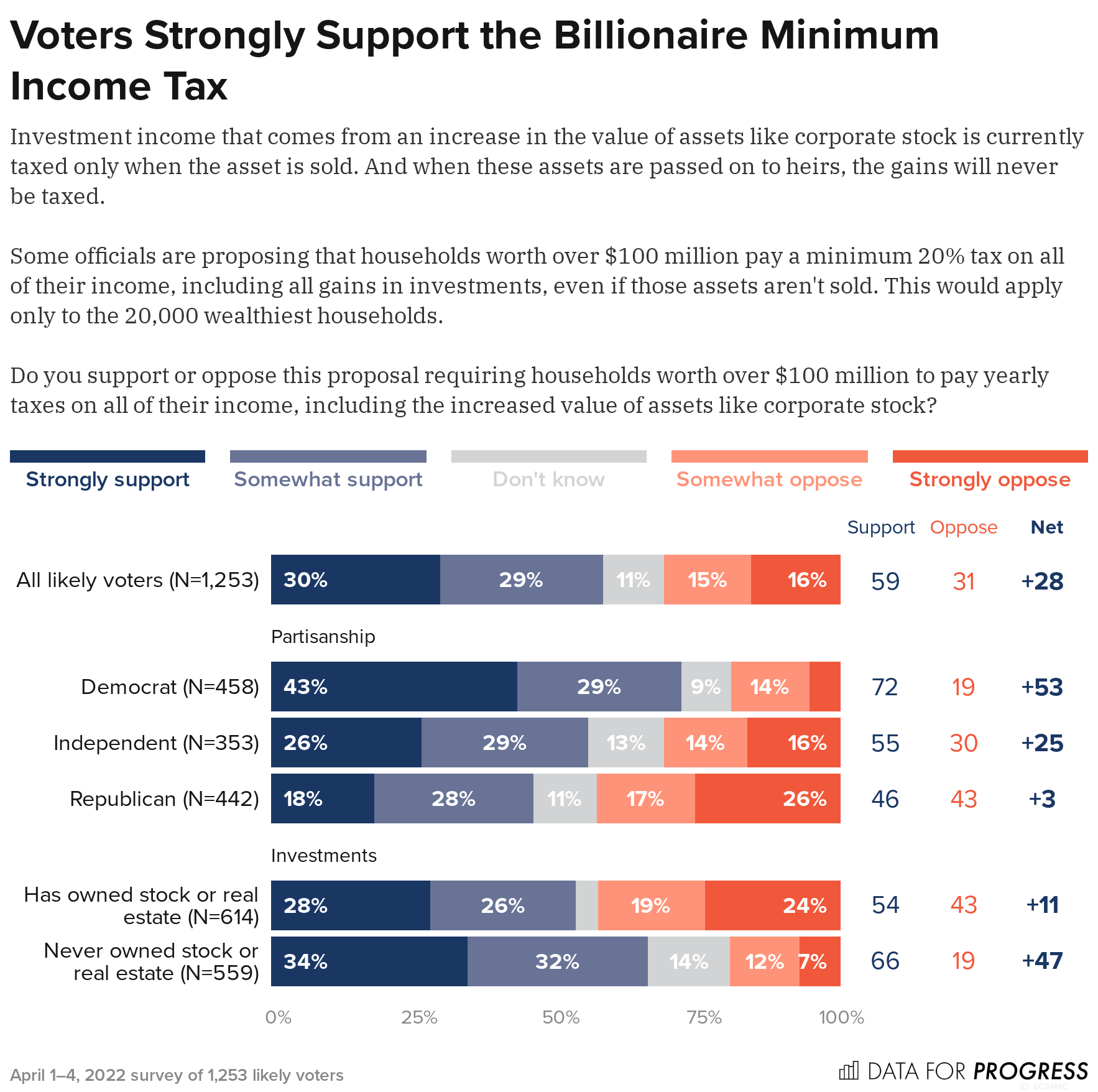

Taxing billionaires' full income, including investment gains, as in President Biden’s Billionaire Minimum Income Tax, is very popular: 59 percent of voters support an outline of the proposal, compared to only 31 percent opposed. Even Republicans support it.

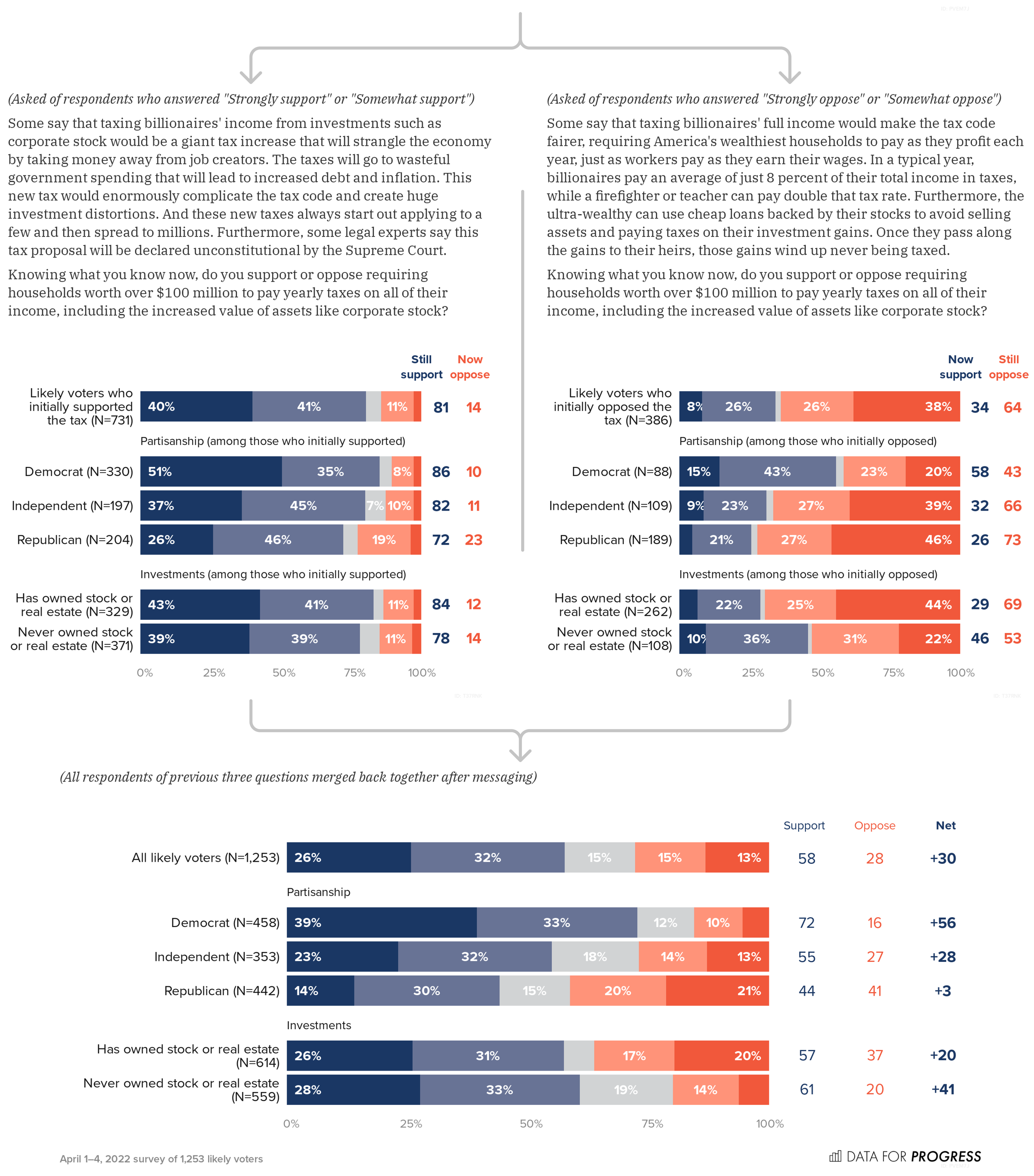

This support is robust: After hearing arguments against the Billionaire Minimum Income Tax, only 14 percent of supporters are persuaded to oppose the proposal. In contrast, after hearing arguments in favor of the proposal, 34 percent of opponents are persuaded to support it.

Introduction

As President Biden puts it, his budget “rewards work, not wealth.”

America’s imbalanced tax code means that many millionaires and billionaires end up paying lower tax rates than middle class workers. In 2021 alone, America’s more than 700 billionaires saw their wealth increase by $1 trillion, yet in a typical year, billionaires like these would pay just 8 percent of their total realized and unrealized income in taxes. A firefighter or teacher can pay double that tax rate.

In an April 2022 national survey, Data for Progress explored voters’ understanding of how income is taxed and gauged support of President Biden’s new plan, the Billionaire Minimum Income Tax.

First, we find that 66 percent of likely voters, including 53 percent of Republicans, think American billionaires should pay more in taxes, while only 4 percent think billionaires should pay less in taxes. (This replicates our previous polling.)

There is bipartisan consensus that billionaires should pay more in taxes — but why are billionaires’ apparent tax rates so low in the first place?

Voters Have a Limited Understanding of How Investment Gains Are Taxed

Let’s imagine a household that owns stock that increases in value during the year. The household does not sell the stock and continues holding it through the end of the year. Must this household pay a tax on the increase in value of this stock?

This hypothetical household owes no tax on this stock, because no tax is owed on gains in investments like stock and real estate until one sells them. However, we find that only 48 percent of likely voters are able to correctly answer this question.

Grasping the intricacies of how investments are taxed (or not taxed, in this example of “unrealized capital gains”) is especially challenging when one has never owned investments like stock or real estate. Among those in our sample who have never owned stock or real estate, only 37 percent correctly answer that no tax is owed on stock gains, compared to 62 percent of real estate and stock holders.

This aspect of the tax code is part of why America’s billionaires pay just 8 percent of their full income in taxes in a typical year — they only pay taxes when they sell, and they avoid selling. Addressing this issue is one way to ensure billionaires pay more tax in a year like 2021, when they increased their wealth by $1 trillion largely through gains in their corporate stock holdings.

Taxing All Income, Including Investment Gains, Is Popular

In March, President Biden proposed a Billionaire Minimum Income Tax, which would introduce a tax on all income, including investment gains — even when those investments are not sold:

For too long, our tax code has rewarded wealth, not work, and contributed to growing income and wealth inequality in America. Under current law, when an American worker earns a dollar of wages, that dollar is taxed as they earn it. But when a billionaire earns income because their investments increase in value, that gain is too often never taxed at all. …

The Billionaire Minimum Income Tax will ensure that the very wealthiest Americans pay a tax rate of at least 20 percent on their full income, including unrealized appreciation. This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters. …

In effect, the Billionaire Minimum Income Tax payments are a prepayment of tax obligations these households will owe when they later realize their gains. This approach means that the very wealthiest Americans pay taxes as they go, just like everyone else, and eliminates the inefficient sheltering of income for decades or generations.

Data for Progress polled this proposal and attempted to simulate an environment where voters hear arguments for and against the Billionaire Minimum Income Tax. First, we described how capital gains are currently taxed and asked voters if they support a proposal in which households worth more than $100 million would pay taxes on all of their income, including the increase in value of assets like corporate stock whether or not the asset is sold. We find that voters support this by a +20-point margin.

Next, we went into more detail, noting that gains are currently not taxed when passed on to heirs and that the Billionaire Minimum Income Tax is a 20 percent minimum tax that would apply only to the 20,000 wealthiest households. We find that support for the tax increases to a +28-point margin of support, including a +3-point margin among Republicans.

Support for the Billionaire Minimum Income Tax Is Robust

Finally, we divided respondents into two groups: Supporters of the tax were shown arguments against the tax and opponents of the tax were shown arguments for it. We find that support for the proposal is robust: After hearing arguments against the proposal, only 14 percent of supporters are persuaded to oppose it. In contrast, after hearing arguments for the proposal, 34 percent of opponents, including 26 percent of Republicans, are persuaded to support it.

Thus, we find that after hearing arguments for and against, likely voters support the Billionaire Minimum Income Tax by a +30-point margin, including a +3-point margin among Republicans.

Conclusion

Most voters don’t understand that wealthy Americans don’t pay taxes as they profit on investment gains. Taxing all income, including investment gains, as President Biden’s Billionaire Minimum Income Tax would do, is popular, and becomes more popular as voters learn about it. In addition to righting fundamental unfairness in the federal tax code, our polling shows that the Billionaire Minimum Income Tax is a political winner, with support robust to attacks and debate.

Jason Katz-Brown (@jasonkatzbrown) is CTO of Data for Progress.