Voters Support an Expanded Child Tax Credit, Oppose Corporate Tax Decreases

By Abby Springs

Last week, a bipartisan group of House lawmakers announced a compromise on a $78 billion tax deal. The legislation would narrowly expand the Child Tax Credit (CTC), allowing families who earn at least $2,500 per year to receive up to $2,000 per child annually by 2025. The expanded CTC, although not as expansive as the pandemic-era changes that expired at the end of 2021, would lift as many as 400,000 children out of poverty.

However, the deal also includes corporate tax breaks that apply to many of the largest U.S. companies. New Data for Progress polling, fielded from January 19-21, finds that voters largely support the expanded CTC, but do not believe that the U.S. should lower taxes on large corporations.

The polling finds that 49% of voters consider child poverty to be a “big problem,” while 41% say it is “somewhat of a problem.”

Seventy-one percent of voters support an expanded Child Tax Credit that provides up to $2,000 per child per year for most families. This includes 79% of Democrats, 67% of Independents, and 66% of Republicans.

The survey also asked voters if they support an expanded CTC with full refundability, meaning it would be available to all families, even if they do not earn an income. Full refundability would allow children from the poorest families to benefit from the credit, but Republicans have resisted removing the income requirement.

Sixty-three percent of voters say they support this version of the CTC, including 50% of Republican voters.

However, the bipartisan tax deal also includes several tax cuts that would decrease the effective tax rate for many large corporations.

When asked whether taxes on large corporations should be increased, decreased, or remain the same, a majority of voters (57%) believe they should be increased. Twenty-eight percent believe they should be left where they are now, while only 9% think they should be decreased.

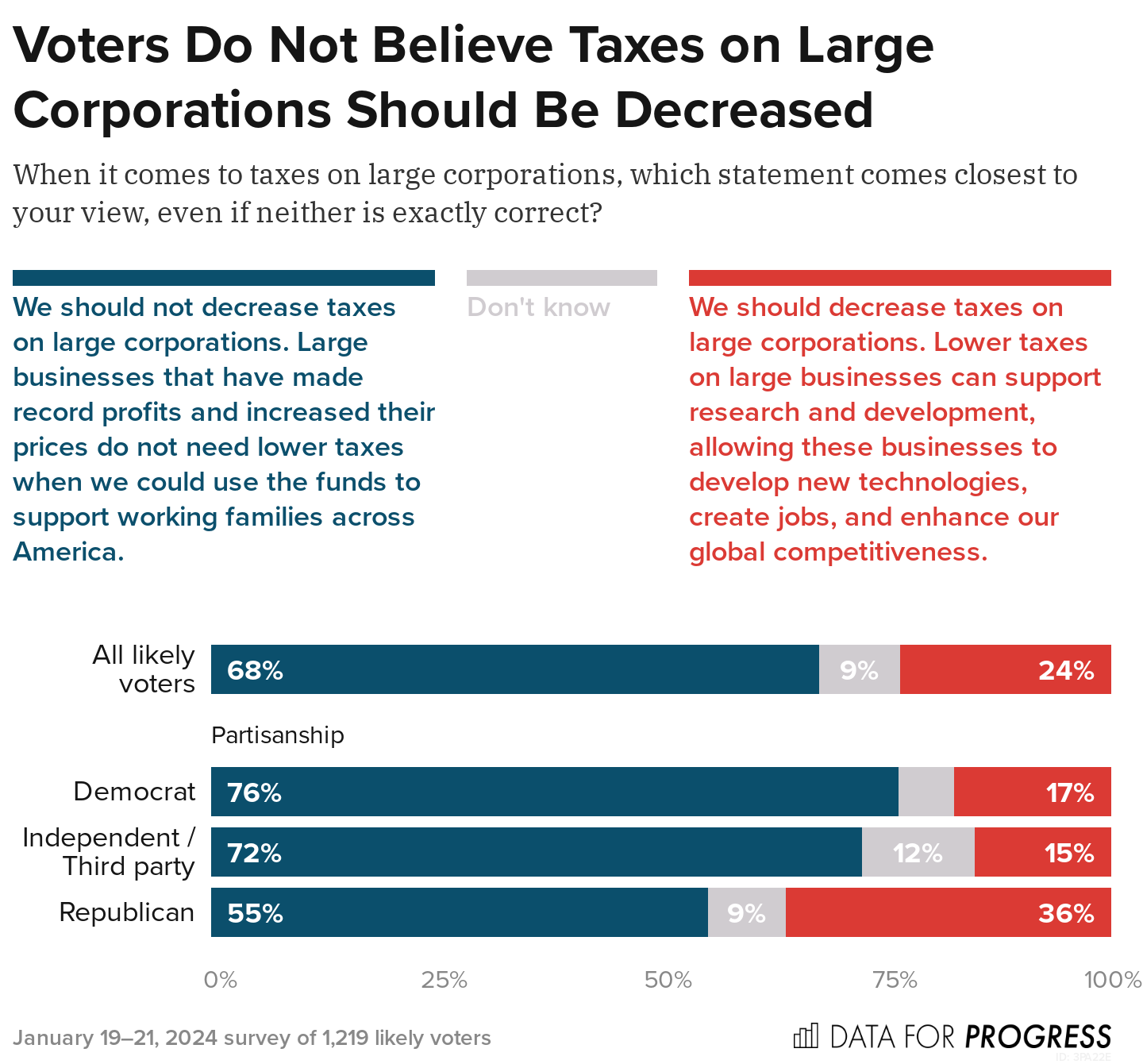

Voters were also presented with two arguments, one for and one against decreasing taxes on large corporations. Sixty-eight percent of voters align with the argument against decreasing taxes, while only 24% agree more with the argument in favor of decreasing taxes to promote research and development.

While the current version of the bipartisan tax deal will help families who struggle to afford their everyday needs, voters also support a deal that goes further to help low-income families without cutting taxes for corporations making record profits. As lawmakers discuss the final provisions of the deal, it is clear that voters overwhelmingly view childhood poverty as a problem in our country and support an expansion of Child Tax Credit that centers working families over corporations.

Abby Springs (@abby_springs) is the Press Secretary at Data for Progress.