Voters Are Interested in Rooftop Solar, but See Barriers to Personal Adoption

By Eva Brungard

2024 has been a challenging year for rooftop solar adoption. While more than 4.8 million American households now have solar panels — one-third of which are in California — policy changes have contributed to a projected 26% drop in installations nationwide this year. During the first half of the year, residential solar installations declined in 41 states, signaling that 2024 would likely be a slower year for solar growth. Despite this slowdown, high electricity bills and frequent power outages continue to drive consumer interest in rooftop solar, with residential solar expected to grow at an annual rate of 14% through 2028.

To better understand public attitudes on residential solar, Data for Progress surveyed likely voters about their perceptions of rooftop solar and potential barriers to its adoption, as well as their support for solar-related policies. The findings reveal strong bipartisan support for solar energy, but highlight key obstacles to solar deployment, such as high upfront costs and limited awareness of available incentives like tax credits or rebates.

Voters are highly interested in residential solar. Although only 8% of voters report they currently have solar panels installed, in a later question, nearly half (47%) report that they are somewhat or very likely to consider a solar installation on their home within the next five years. Younger voters — those under 45 — show stronger interest (64%) in solar adoption, compared with older voters (39%).

The findings suggest that this enthusiasm is rooted in the perceived benefits voters associate with rooftop solar. When asked about the potential benefits of solar, 63% of voters believe pairing solar panels with battery storage can reduce the frequency of blackouts, and 65% anticipate it would lower their electricity bills.

Among those who say they would consider installing a residential solar system in the next five years, the primary motivation for doing so is reducing their electricity bills (43%). Meanwhile, 19% cite the importance of backup energy during extreme weather events, and 17% point to a desire to be self-sufficient or independent from the energy grid. In contrast, only 14% of respondents identify reducing their carbon footprint as their top motivator.

Despite the perceived economic and reliability benefits of solar, financial hurdles remain a significant barrier to adoption. Among those who say they are not likely to consider installing solar, the upfront cost is the biggest obstacle, with 39% of respondents citing it as their main reason for not pursuing rooftop solar. Renters and others who are not the head of their household also face unique challenges, with 26% of voters stating that they lack the decision-making authority to make permanent changes to their homes. Among renters specifically, 63% say this is the main factor, while for homeowners, costs are the primary reason (52%).

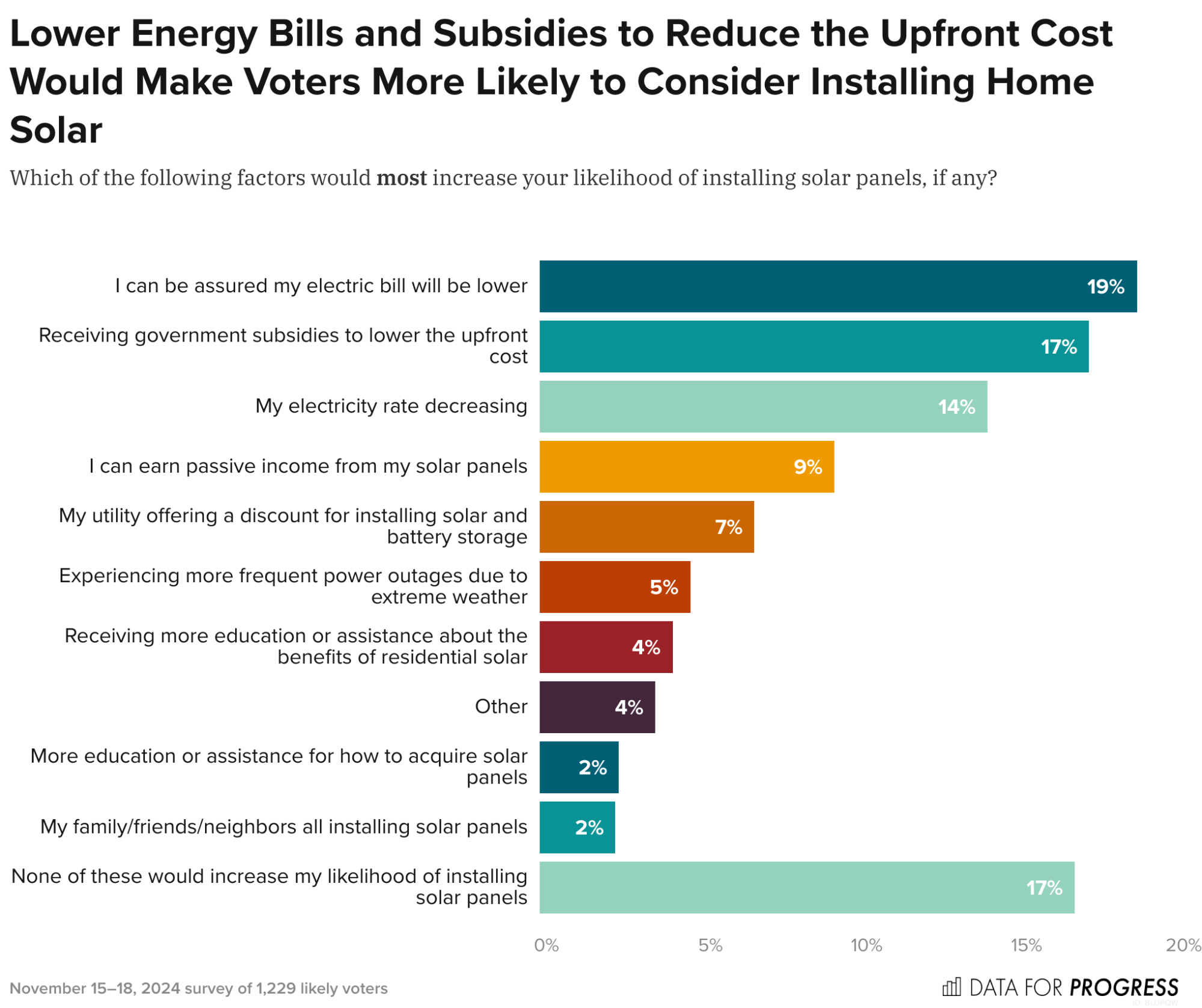

When asked what measures would be most effective in increasing their likelihood of solar adoption, respondents cite a need for assurances that rooftop solar would reduce electric bills (19%) and subsidies to lower upfront costs (17%). The federal government provides homeowners a tax credit of up to 30% of the total cost to install a solar system, with more than 20 states offering additional incentives. However, while existing tax credits at the federal, state, and local levels can help reduce costs, only 34% of respondents say they are aware of such incentives in their state, highlighting the need for increased education and outreach.

In addition to assessing personal attitudes toward and perceptions of residential solar, the survey assessed views of different policies to incentivize the adoption of solar and battery storage systems.

Net metering offers a way for owners of residential solar systems to sell excess electricity they generate back to the grid, and in some states, to receive electric bill credits for the electricity they generate. When presented with a description of net metering, along with arguments for and against the policy, voters express clear bipartisan support for net metering to allow greater compensation for solar owners, with 68% of voters supporting this policy.

In contrast, after voters read about a proposal to introduce a residential fixed charge on utility bills for solar customers to help maintain the electric grid, support is more divided. A slim majority (53%) of respondents are in support of such a policy, while 31% are opposed.

Virtual power plants (VPPs) have emerged in recent years as a strategy to use smaller, distributed renewable energy sources to affordably supply electricity, yet very few voters have heard anything about the topic. When asked about their familiarity with the term, 63% of voters say they are not familiar at all, and 21% are only a little familiar. Respondents later read a description of VPPs and were asked to consider if they would support a program to compensate residential solar owners for participating in a VPP if they were an owner of a residential solar and battery storage system. After reading this brief description, an overwhelming 80% of respondents say they would support such a program if they owned a residential solar and battery storage system.

These findings highlight the importance of bridging the gap between consumer interest and action on residential solar adoption. Investments in education about the benefits of solar, including reduced energy costs, coupled with outreach to ensure voters are hearing about targeted financial incentives to bring down the upfront costs of installation, could help remove barriers and accelerate solar deployment and the transition to a more sustainable energy future.

Eva Brungard is the Climate and Energy Program Intern at Data for Progress.

Survey Methodology

From November 15 to 18, 2024, Data for Progress conducted a survey of 1,229 U.S. likely voters nationally using web panel respondents. The sample was weighted to be representative of likely voters by age, gender, education, race, geography, and 2020 recalled vote. The survey was conducted in English. The margin of error associated with the sample size is ±3 percentage points. Results for subgroups of the sample are subject to increased margins of error. Partisanship reflected in tabulations is based on self-identified party affiliation, not partisan registration. For more information, please visit dataforprogress.org/our-methodology.